Budget Help

- Key Concepts

- Getting Started

- Work with Accounts

- Working With Bank Accounts

- Multiple Bank Accounts

- Moving Accounts

- Balance/Reconcile Bank Accounts

- Associating Envelopes with Bank Accounts

- Work with Envelopes

- Work with Income

- Record Transactions

- Work with Transactions

- Calendar

- Investments

- Calculators

- Import/Export/Sync

- Reports/Statistics

- Preferences

| Cash |

| Check Register |

| Credit Cards |

| Savings Accounts |

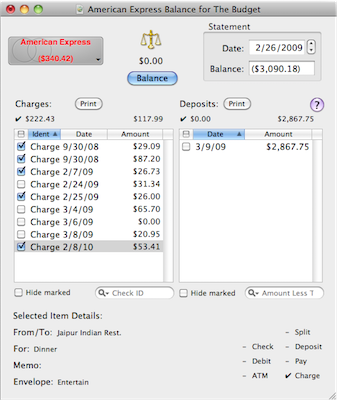

Balancing Your Bank AccountsBalancing a bank account (Checking, Savings, or Credit Card) is a simple process in Budget. To access the Balance window, first select the account and then use the Accounts > Balance... menu command. The Balance window has the account total in the upper left corner and the statement date and balance field in the upper right. The list of items on the right side are the deposits, and the list of items on the left side are withdrawals (checks, debits, ATM, etc.). Payments and charges will be listed if you are balancing a credit card account. In the top center of the Balance window is the balance indicator and amount. When your budget and the bank agree the balance indicator will be level and the amount will show $0.00. If the indicator is not level then the amount shown is the difference between your Budget bank account and the real bank. The indicator must be level before you can balance your bank account. (See also the section on Force Balance below). Clicking the column header IDENT in the check list sorts the list by the check number. Clicking the column header DATE in either list sorts the list by date. Double clicking an item in the balance lists will display complete information about the transaction in the Transaction Information window.

How To Balance A Bank AccountWe use a checking account for this example, but the process is the same for a credit card account. If you have more than one bank account defined, select the account you want to balance. See the Multiple Bank Accounts topic for more information.

Force BalanceCan't get the bank account to balance correctly? You can force your bank account to agree with the bank. Proceed as you normally would for balancing your bank account. Enter and check all the known items on your bank statement then enter the bank's balance into the STATEMENT BALANCE field. When you have all the known items checked off use the Accounts > Force Balance menu command. A transaction with the amount shown under the balance icon will either be added to, or subtracted from, the "Available" envelope. Your bank account will be balanced.

|